If you’ve been hearing about how you can invest in the new satellite constellation Starlink and make big money, then you’re probably wondering whether it’s really worth your time and money. After all, this isn’t exactly a typical investment strategy, so it’s essential that you know what you’re getting into before you put any of your hard-earned dollars on the line. This guide will help you evaluate the pros and cons of investing in Starlink, so that you can determine if it’s right for your situation and goals.

What is Starlink?

If you’re interested in Starlink and want to know if it’s worth investing in, there are three things you need to consider before making your decision. The first is whether or not the company has an industry-standard product; the second is whether or not they have a proven track record; and the third is whether or not their pricing is competitive. If Starlink passes all three of these requirements, then you should feel more comfortable investing in them. Their business model has been set up in such a way that they can continue improving the product as needed (and can offer a less expensive model for consumers). The technology behind this satellite network is promising as well, and the team consists of qualified experts from major organizations such as NASA and SpaceX. The market opportunity for Starlink could be huge – with space being so crucial for future technological growth on Earth, and satellites being so necessary for communicating with people on Earth, especially those living in rural areas.

The business model

If you’re considering investing in this new space company, it’s important to know the business model. The company is going through an Initial Public Offering (IPO) and selling shares of their company. The initial cost of one share is $97. Investing in the IPO will allow you to invest early on, but there are risks involved with investing before the IPO goes live on December 10th. There are also alternative ways you can invest in Starlink: by buying at least $100 worth of shares through the crowd funding website or by purchasing shares from other investors on an investment platform such as Sharespost and Second Market. Keep in mind that while the business model is interesting, the risk level could be high.

The technology

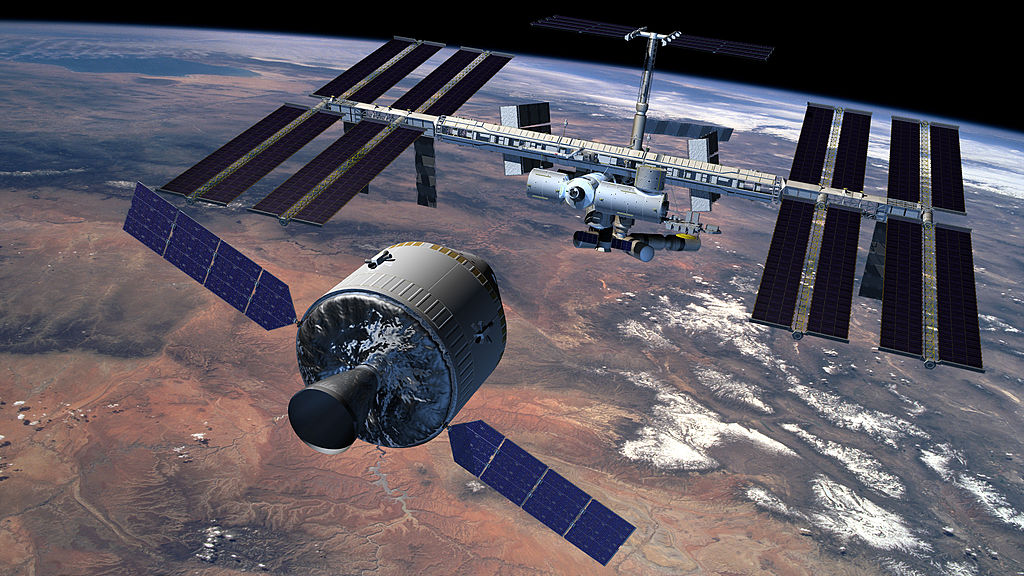

The first thing people often ask when considering whether or not Starlink will be a good investment is what the technology does. What does it look like, how does it work, who are the competitors, and is there demand for the product? The company has said that It’s time to put more satellites in space, and that they plan on deploying more than 12,000 satellites in Earth’s orbit to deliver internet access worldwide. And by doing so, they’ll offer faster internet speeds at lower costs for both consumers and businesses. They’re entering an already saturated market (Satellites) but with sky-high goals.

The team

Starlink has assembled a strong team of industry leaders and the company is backed by private equity. The team has experience launching satellite constellations and managing large networks. They have also secured key government partnerships that will help with the deployment and regulatory processes. The company’s advisory board includes top executives from leading aerospace firms like Lockheed Martin, Boeing, Thales Alenia Space, Honeywell Aerospace and Harris Corporation. These advisors bring valuable expertise in the fields of software development, orbital mechanics, manufacturing and international law to the table. The team is led by Founder & CEO Elon Musk (Tesla) & Founder Greg Wyler (Google). The advantage here is that this isn’t some new start-up without any history or experience in this field. Instead they are coming out of the gate with deep knowledge of what it takes to get satellites into space as well as other technologies like communication networks which are vital for an IoT network like Starlink.

The market

Investing in the market can be difficult and risky. That’s why it’s important to do your research before making any big decisions. In the case of Starlink, there are many factors that may influence whether or not this is a good investment for you. The first thing you should do is look at their financials – how much money they’ve made in the past, what they’re projecting they will make in the future, and how much debt they have on their books. All of these factors will determine if investors are going to want to put more money into the company, which would then go up in value over time. The most reliable way to know if the market wants to invest in something is by watching the stock price. When stocks drop too low, the companies offer special discounts called IPOs (Initial Public Offering). If people think that a company might become successful in the future, they buy stock at discounted rates before it goes back up again so they can get their investment back out plus a profit. It’s smart to stay abreast with both the public and private markets because often times things happen all around us without us even knowing about them.

The competition

It’s not hard for investors to see that the competition is hot. Some of the biggest names in the industry are competing with one another for market share, and there’s only room enough for so many. In fact, one of the largest challenges companies are facing right now is that they’re having trouble expanding their reach because they’re running into other established players.

This means that investors need to be more selective when choosing which company they want to invest in, because there isn’t enough room in the industry for every company to succeed. This can make it difficult for newer companies who might be looking at entering into this market, because they might not have as much access as established competitors who already have some clout with consumers.

The opportunity

Starlink is the first satellite-based Internet service available globally. The opportunity for business owners is that they can make use of this service in order to reach new customers and build new partnerships. Whether you’re looking for international or local exposure, or a way to have your product seen in more places, Starlink might be the perfect investment for you.

Starlink has been credited with providing Internet access in areas where it was not previously available, such as rural communities and developing countries. This has the potential to help businesses grow exponentially by connecting them with their customers on the other side of the globe. For example, one US company managed to acquire an overseas customer through the use of this technology. As the world becomes increasingly globalized, Starlink will only continue to be more valuable and profitable. The opportunities are truly endless with this project, from increased visibility on Google Maps to having video conferences around the world possible.

What are some concerns about investing in starlink?

Risks

In order to make an informed decision on whether or not you should invest in Starlink, you need to be aware of the risks. It is important that you know what these risks are and how they can affect your investment. The first risk is the possibility of the game being postponed or canceled due to unforeseen circumstances. This would mean that those who invested would lose their money and have nothing left over. Another risk is the rate at which the market will buy up this game and if it will do so before many people get access to it. If this happens, then there may be fewer available copies for those who had planned on investing in it because they would not have been able to purchase one before others did.

Conclusion

There is always risk associated with investing in any project, but the payoffs can be significant. When deciding whether or not to invest in STAR, one must weigh all the information and decide for themselves if the risk outweighs the reward. It’s crucial to do your own research and come up with your own conclusions. The possibilities are endless and this is just my opinion of what could happen. In conclusion, I would recommend investing in STAR and doing your own research to see if it’s right for you.