Inflation is an important economic concept that can have a significant effect on the value of your money. But how do we measure inflation rate? In this blog post, we will discuss why inflation matters and how to measure inflation rate. We will look at different methods for calculating inflation, including the consumer price index (CPI), producer price index (PPI), and GDP deflator. Understanding inflation and knowing how to measure it can help you make informed financial decisions.

How to Measure Inflation Rate

What is inflation?

The most common measure of inflation is the Consumer Price Index (CPI), which tracks the price of a basket of goods over time. The CPI gives us an idea of how much prices have increased over a certain period, such as a year or month. Other indicators, such as the Producer Price Index, also measure changes in prices.

Inflation can be caused by a variety of factors, including changes in the money supply, production costs, and demand for goods and services. Inflation can be beneficial in some cases, as it can boost consumer spending and investment. However, too much inflation can lead to higher unemployment and a decrease in consumer purchasing power. It’s important to keep an eye on inflation to make sure it doesn’t get out of control.

How do you measure it?

Inflation is an important economic indicator to consider when making decisions about budgeting, investing, and planning for the future. Understanding how inflation is measured can help you make smarter financial decisions. So, how do you measure it?

Inflation is calculated by looking at the Consumer Price Index (CPI), which measures the average change in prices of goods and services purchased by consumers over time. The CPI compares the prices of a basket of items each month with the prices of the same items in the base period. The base period is typically set at the year 1982-84, and the items are reevaluated every two years to ensure they accurately reflect the current market. The CPI is calculated by measuring the average price level of all the items in the basket.

The Bureau of Labor Statistics (BLS) releases monthly figures on the CPI. This data helps to determine the inflation rate for each month and for different geographic areas. The inflation rate is calculated by comparing the current CPI figure to the CPI figure from 12 months prior. For example, if the CPI for June 2020 was 200 and the CPI for June 2019 was 175, the inflation rate between June 2019 and June 2020 would be 14%.

Knowing how inflation is measured can help you make better financial decisions and plan ahead for future expenses. Monitoring changes in the CPI can provide insights into trends in the economy and help you understand what kind of products are becoming more expensive or less expensive.

What are the different types of inflation?

When it comes to inflation, one of the most important questions to ask is What are the different types of inflation? Inflation can be a tricky concept to understand, and it’s important to know what kind you’re dealing with in order to effectively measure it.

Inflation is essentially the rate at which prices for goods and services increase over time. It’s typically measured using the Consumer Price Index (CPI) which takes into account changes in the prices of everyday items such as food, clothing, and housing.

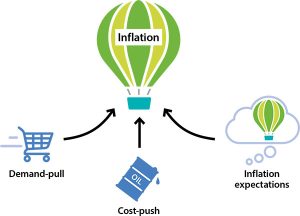

There are two primary types of inflation – demand-pull inflation and cost-push inflation.

Demand-pull inflation occurs when an increase in consumer demand leads to higher prices for goods and services. This is typically caused by increased money supply, an expanding economy, or a higher population.

Cost-push inflation occurs when the prices of production costs increase. This could be due to higher wages, higher taxes, or increased costs of raw materials.

In addition to these two main types of inflation, there are several other causes that may contribute to a rise in prices. These include government intervention, currency devaluation, and speculation in commodities markets.

Understanding these different types of inflation can help you better measure and anticipate changes in prices. By understanding what factors can lead to an increase in prices, you can create strategies to manage your own finances and stay ahead of rising costs.

What are the causes of inflation?

Inflation is a major economic phenomenon, and it affects both the prices of goods and services, as well as the amount of money in circulation. But what are the causes of inflation? Generally, there are two main reasons for inflation: demand-pull and cost-push inflation.

Demand-pull inflation occurs when there is an increase in demand for goods and services without a corresponding increase in supply. This type of inflation can be caused by an increase in consumer spending, or an increase in government spending.

Cost-push inflation is caused by a rise in the costs of production, such as higher wages or increases in the cost of raw materials. This type of inflation can also be caused by increases in taxes and import tariffs.

Inflation is also affected by other factors, such as the growth rate of the economy, the strength of the currency, and the level of unemployment. The central bank is typically responsible for controlling inflation, as it can adjust interest rates to affect the amount of money in circulation.

It’s important to understand the causes of inflation, as it affects almost every aspect of economic life. Knowing what triggers inflation can help businesses plan for price changes, as well as help governments adjust their policies accordingly.

What are the effects of inflation?

Inflation is an economic phenomenon that has a significant impact on our daily lives. It can be caused by many factors such as increased demand, supply shortages, currency devaluation, and government policies. All of these factors affect prices, which in turn affects purchasing power, savings, investments, wages, and the overall economy. But what are the effects of inflation?

Inflation typically leads to higher prices as producers try to keep up with increasing costs. When prices increase, it means that you have to pay more for goods and services, meaning your purchasing power decreases. This can also lead to a decrease in savings, as the value of those savings will be less when compared to the cost of goods and services. Additionally, inflation can also cause wages to increase as employers must pay their employees more in order to keep up with the rising cost of living.

Inflation can also lead to a decrease in investments, as investors must consider whether or not their return will be able to offset the rising cost of goods and services. High inflation rates can also cause a decrease in international trade, as imports become more expensive and exports become less desirable.

Overall, inflation has both positive and negative effects on the economy. While it can lead to increased wages, it also affects purchasing power, savings, investments, and international trade. Therefore, it is important to understand how to measure the rate of inflation and its impacts on the economy.

What are the ways to combat inflation?

Inflation is an economic phenomenon that affects everyone and is often seen as a major challenge for policymakers. The rate of inflation is the measure of the average change in prices for goods and services over a period of time. Inflation can have significant impacts on an economy, as it can erode purchasing power and create instability. As such, governments and central banks must often intervene in order to control inflation rates and protect the economy. So, what are the ways to combat inflation?

One way to address inflation is through monetary policy, which involves controlling the supply of money in circulation in order to affect the price level. Central banks use a range of tools to implement monetary policy, including setting interest rates and buying and selling government bonds in the open market. When the central bank increases the supply of money or reduces interest rates, it stimulates the economy, resulting in increased spending and potentially higher inflation.

Another way to combat inflation is through fiscal policy, which refers to how governments use taxation and public spending to influence the economy. By reducing government spending or increasing taxes, policymakers can help curb inflation by reducing aggregate demand. This can help prevent rapid price increases caused by too much spending in the economy.

Finally, countries can use wage controls to help reduce inflation. Wage controls involve setting limits on wages so that they do not outpace inflation. This helps to ensure that wages remain affordable and that workers can keep up with rising prices.

Inflation can have far-reaching effects on an economy, making it necessary for governments to intervene in order to keep prices stable. With monetary, fiscal and wage policies, policymakers have the ability to effectively combat inflation and maintain economic stability.

This article is enriched by an informative YouTube video titled “What is inflation and how do we measure it? | Economics Explained.” The video is hosted on the Economics Explained channel on YouTube, which provides valuable insights into economic concepts. We extend our gratitude to the content creator for their expertise in explaining the intricacies of measuring inflation.

Conclusion

In conclusion, inflation is an important concept to understand, as it affects so many aspects of the economy. Measuring inflation rate can be a complex process, depending on the country and the economic data available. The most commonly used measure is the Consumer Price Index (CPI), which looks at changes in the prices of goods and services over time. Other methods such as the GDP deflator and producer price index are also used. Understanding how to measure inflation rate can help inform decisions and policies that promote economic stability.